The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:15 am

Good Morning!

Please excuse my tardiness. I converted my chart technology to a new system and am still learning the ropes. Things should go smoother as I progress in the new technology.

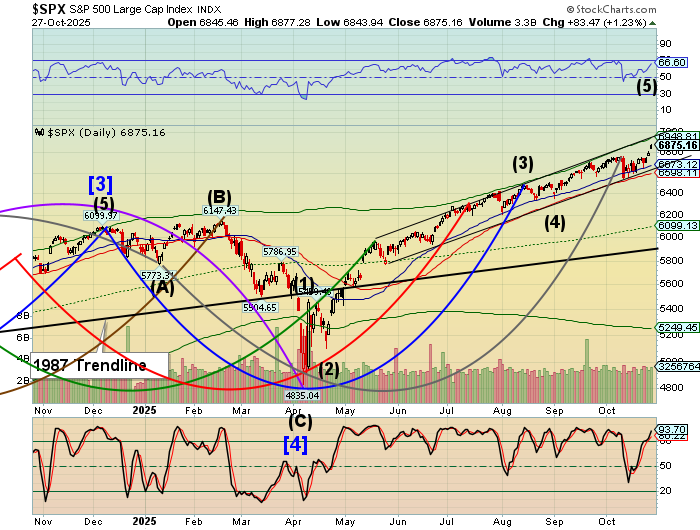

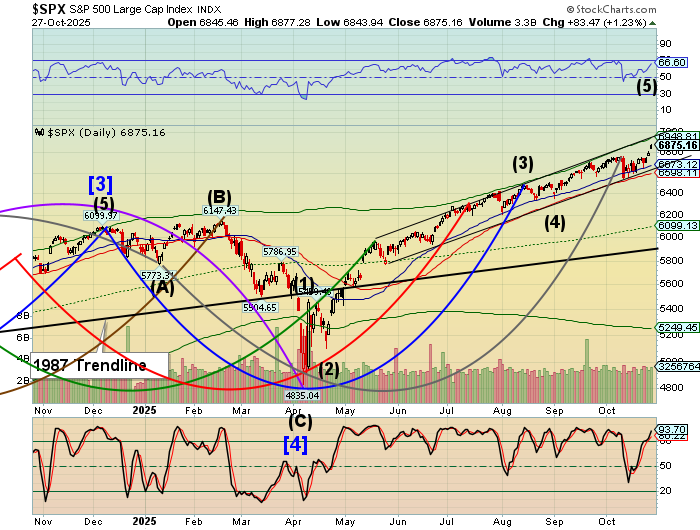

SPX futures rose to 68843.90 as the overnight market attracted more buyers. The Cycles Model suggests the rally may go at least to November 5, but may extend beyond that, due to high levels of FOMO and strong momentum. Investors are betting on an end to QT, giving liquidity another boost. RRP balances are depleted. The fed must stabilize reserves to prevent a funding squeeze and reduce volatility. Inasmuch as it may have an effect on risk-taking behavior, the condition may not last.

Today’s options chain shows Max Pain at 6855.00. Long gamma gives a boost above 6895.00 while short gamma offers a massive put wall at 6840.00. Dealers may do their utmost to keep the SPX “fenced in” between these two guideposts.

ZeroHedge reports, “The record-busting stock rally paused ahead of two huge days which include an avalanche of Mag7 earnings, central bank meetings, and the Trump-Xu summit summit.”

RealInvestementAdvice tells us, “We live in what Brett Arends claimed as “The Dumbest Stock Market In History,” but I believe it is potentially the most dangerous era. That phrase is not hyperbole as it reflects structural distortion, extreme valuations, and an investor base intoxicated by momentum and narrative.’

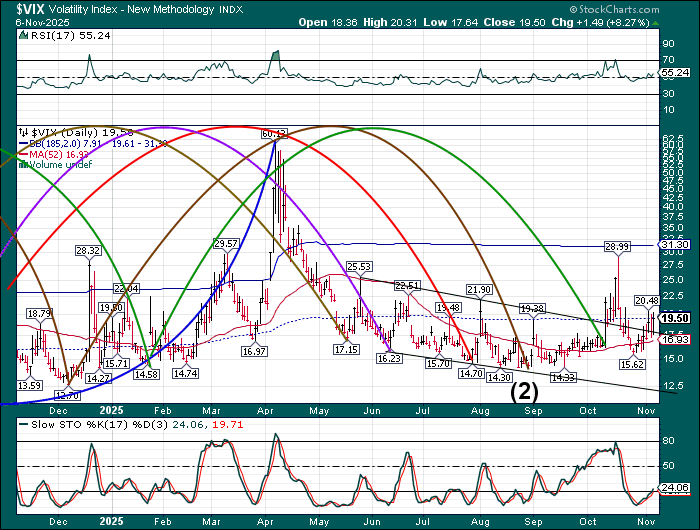

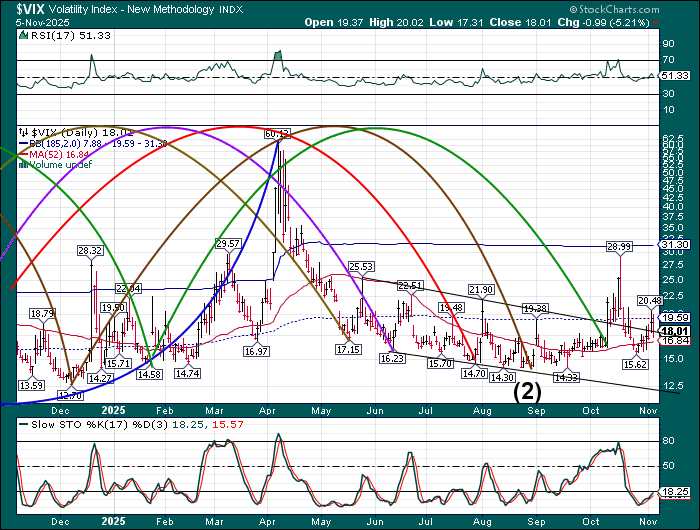

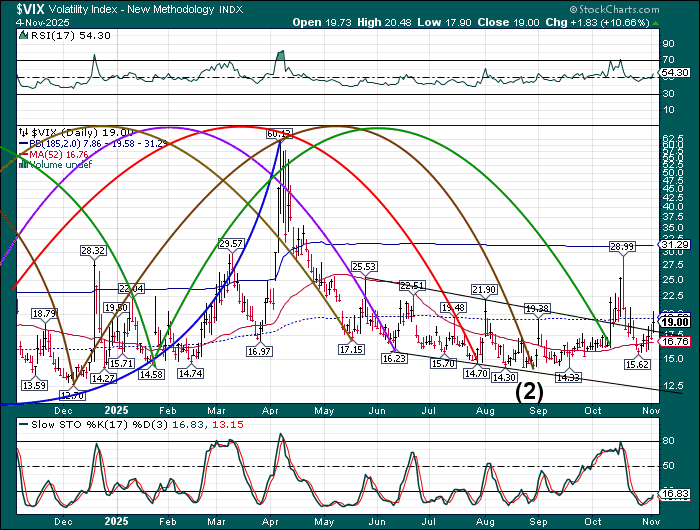

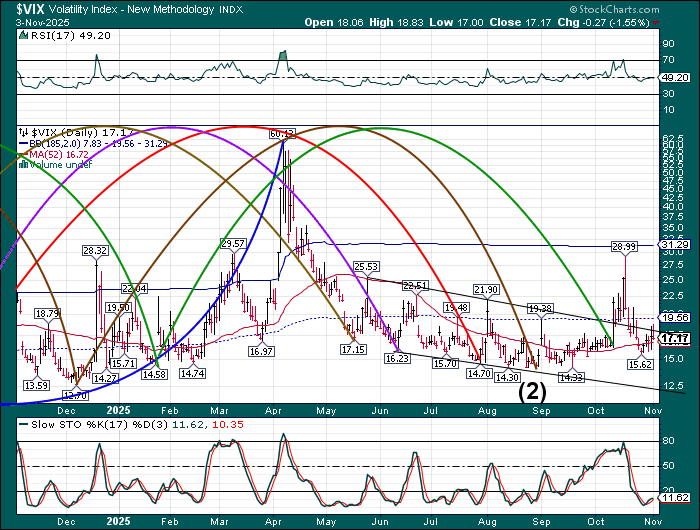

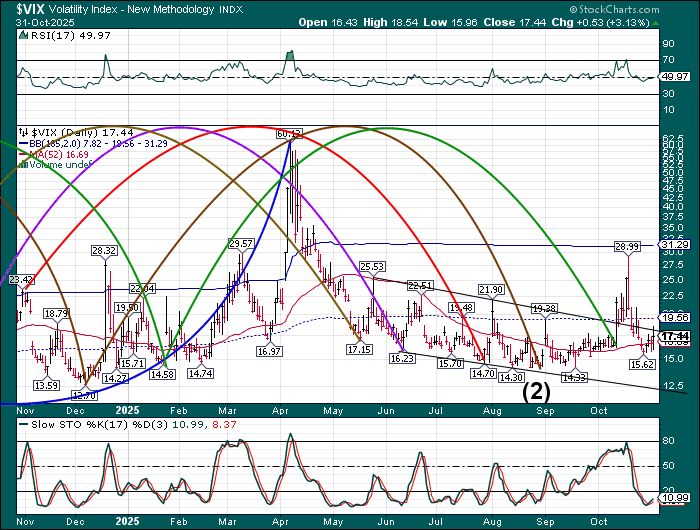

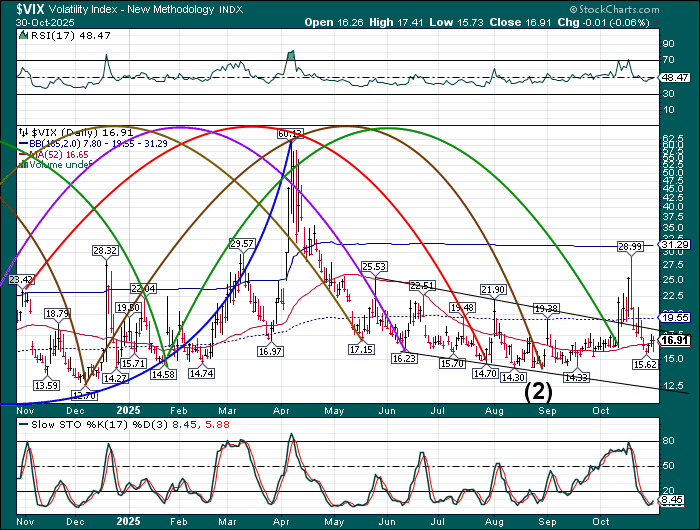

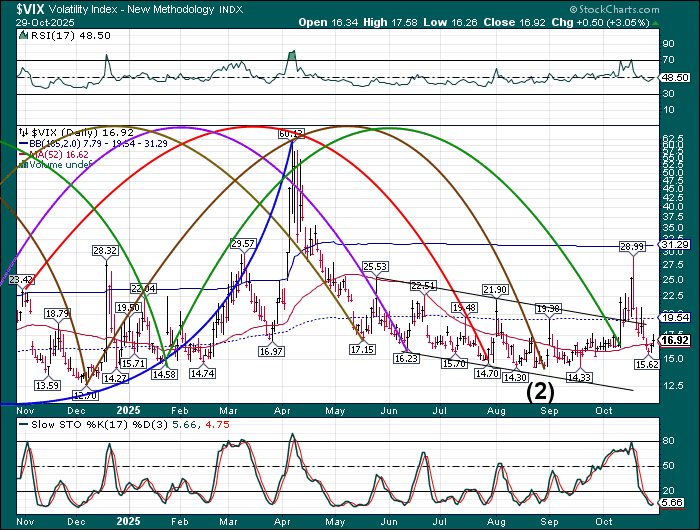

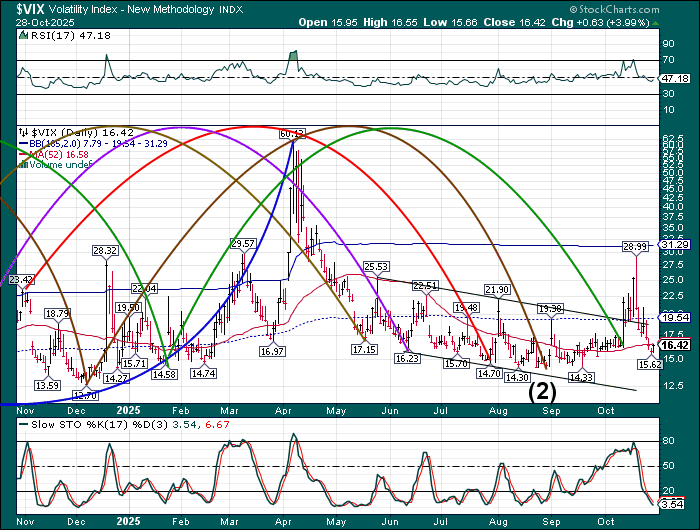

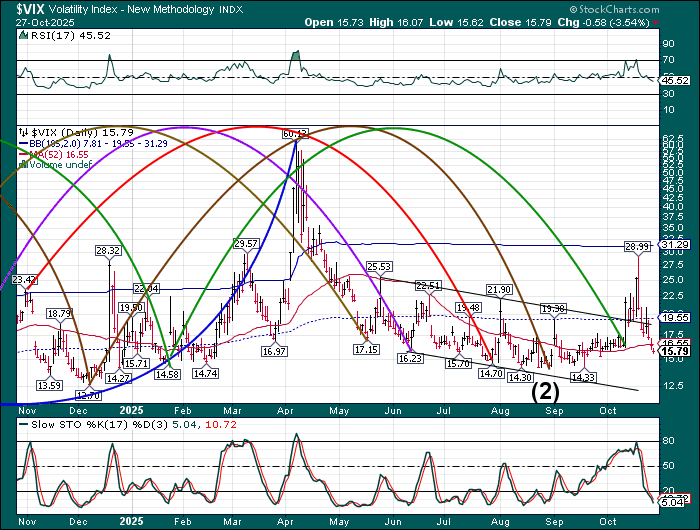

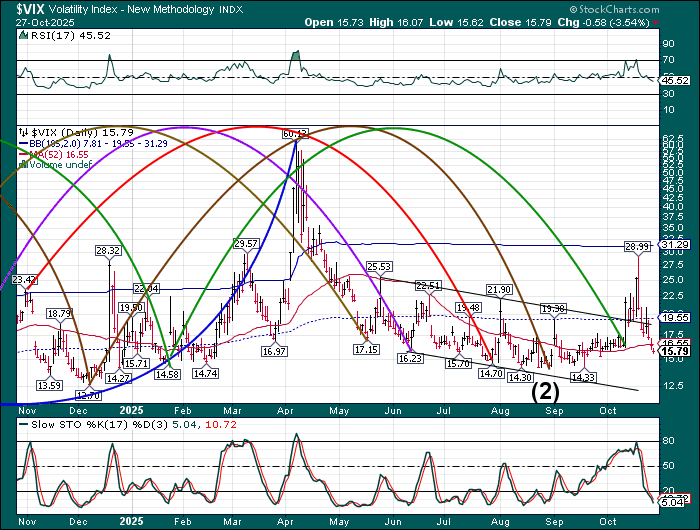

VIX futures have consolidated beneath the 50-day Moving Average at 16.55 this morning. Today may be a Trading Cycle low, allowing the VIX to test the next level of support at 15.00. The Cycles Model suggests that the VIX may remain subdued until early next week, when activity starts picking up.

Tomorrow’s weekly options chain shows Max Pain at 17.00. There is minimal short gamma beneath it. However, long gamma shows a massive call position at 20.00. The Cycles Model shows a potential increase in hedging starting next week.

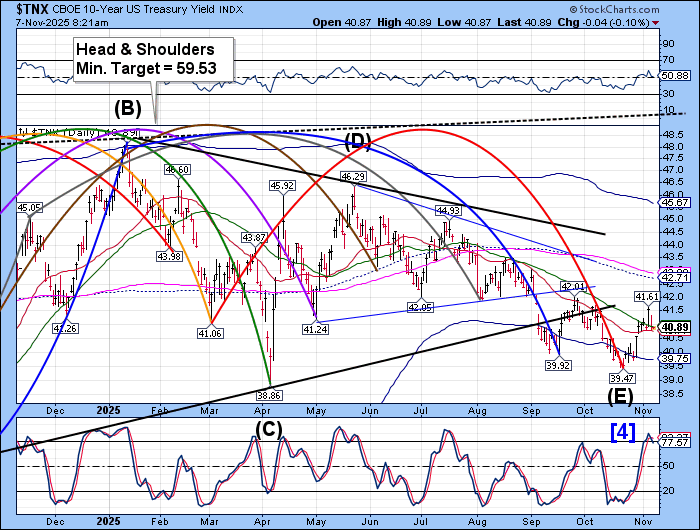

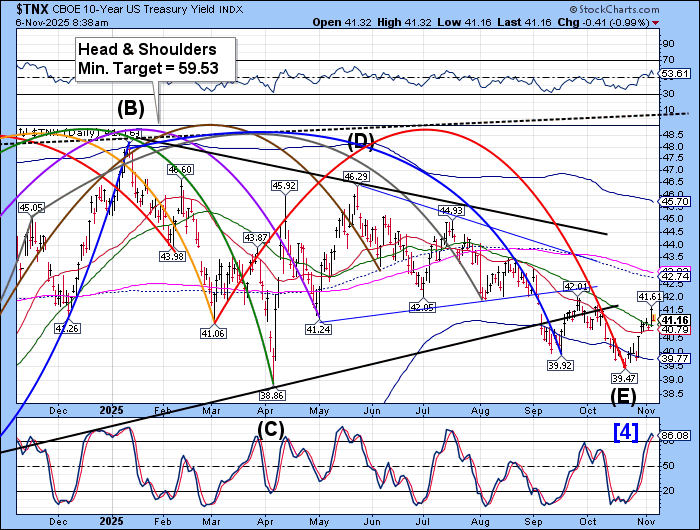

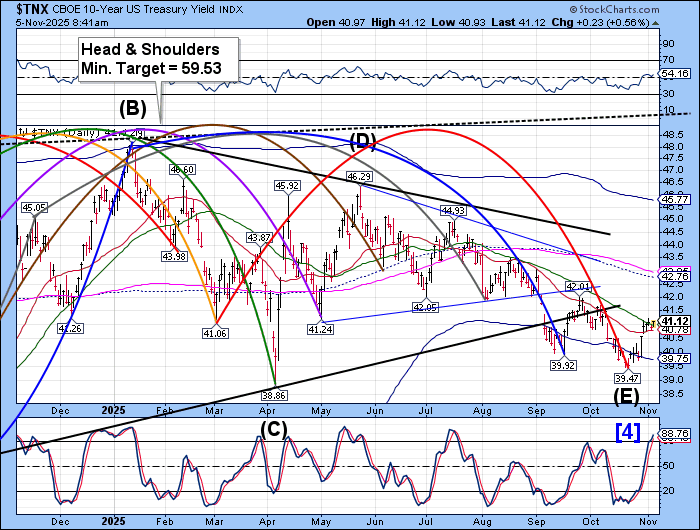

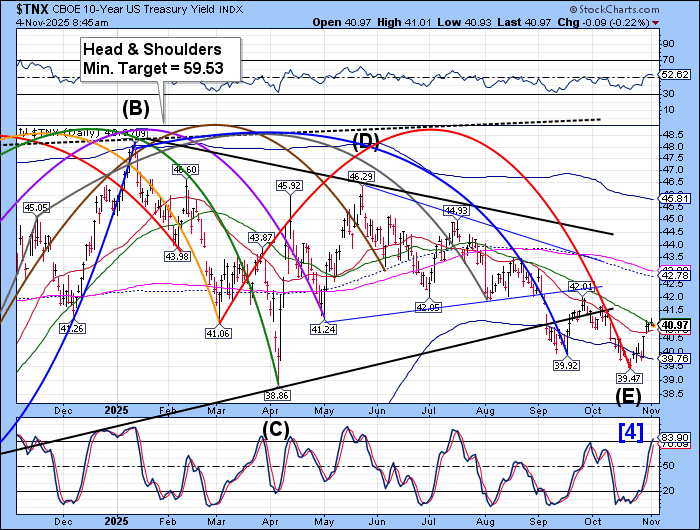

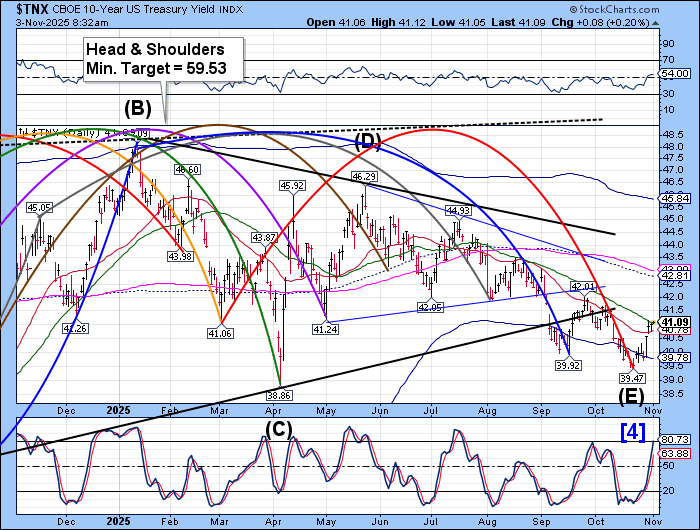

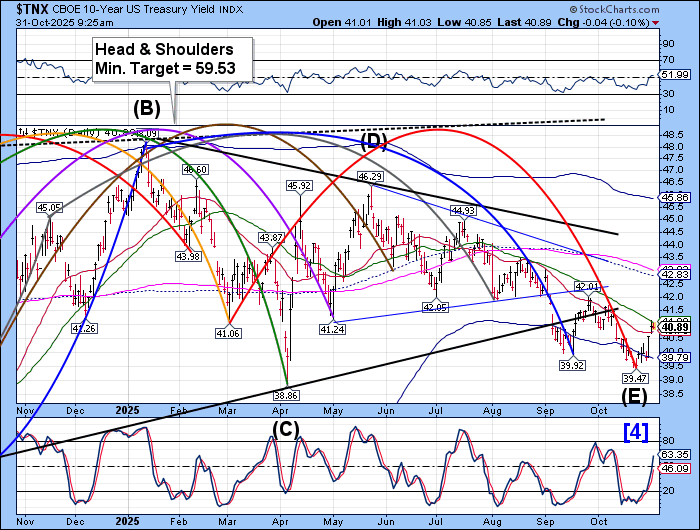

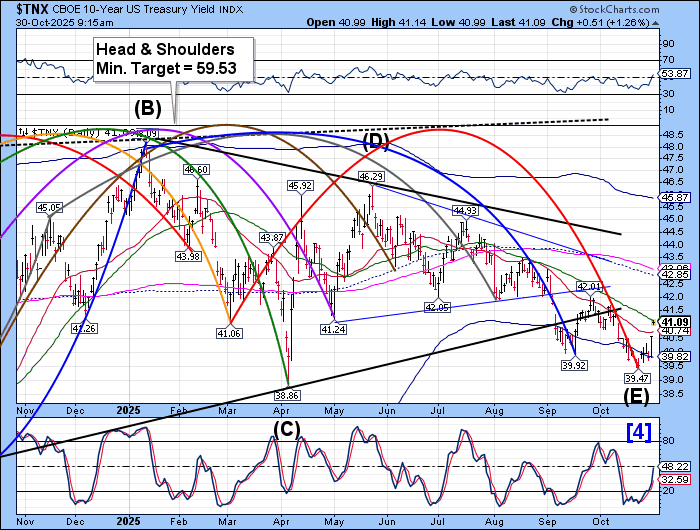

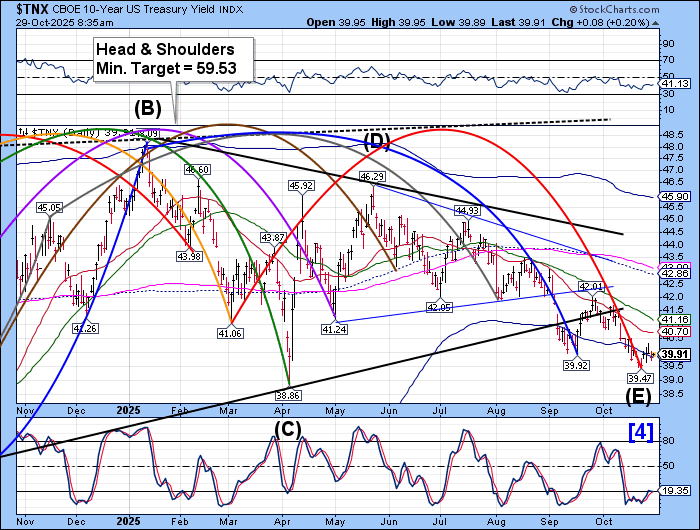

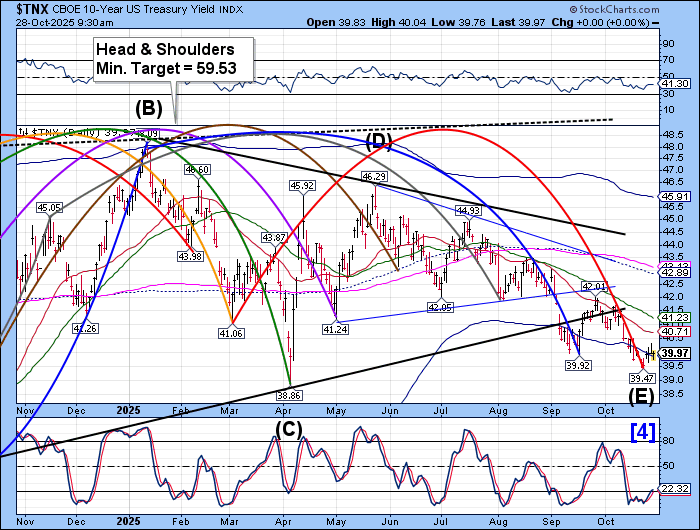

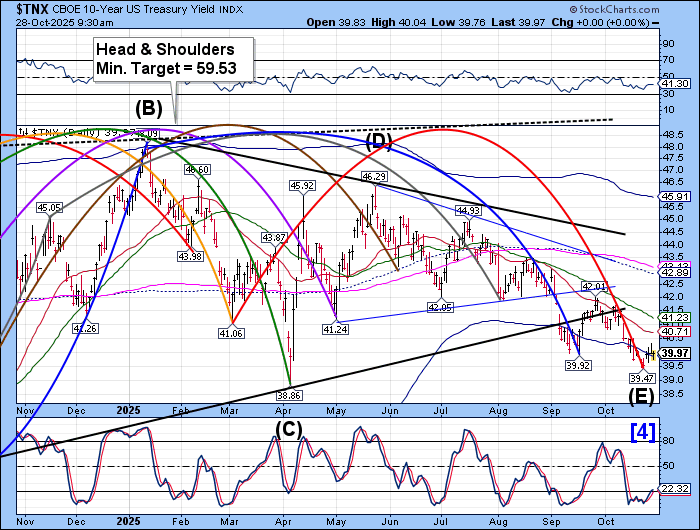

TNX is consolidating along its cycle Bottom at 39.39. It may go lower temporarily, as the FOMC prepares its memo. However, the Cycles Model shows a strong reaction, potentially from the FOMC announcement, starting on Wednesday and extending later into the week.

ZeroHedge remarks, “90 minutes after the day’s first auction, which saw foreign demand for $69Bn in 2Y paper slide, moments ago the Treasury concluded its second coupon auction of the day, and this one was far stronger.”

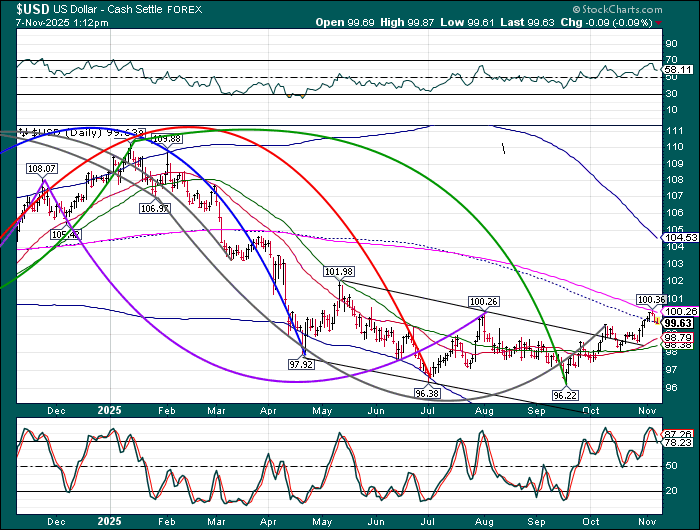

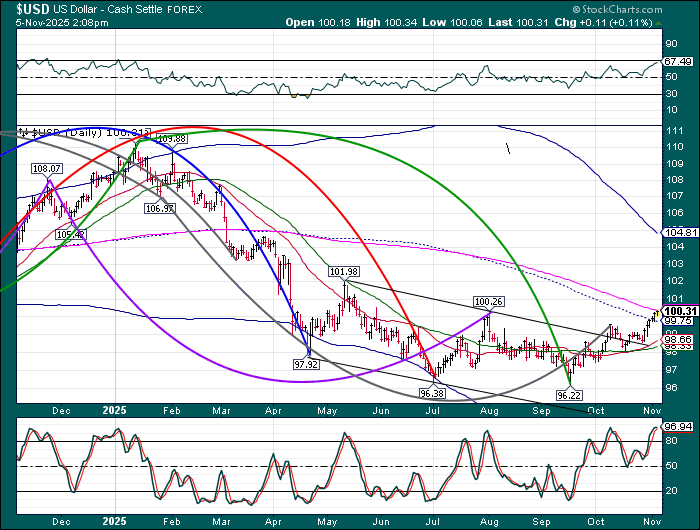

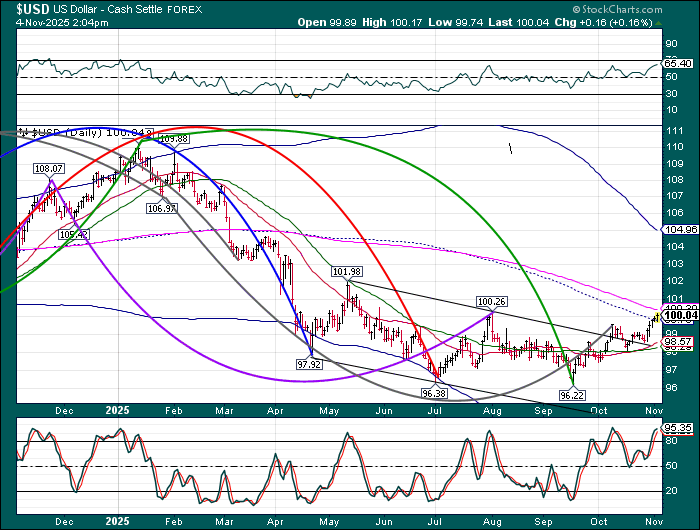

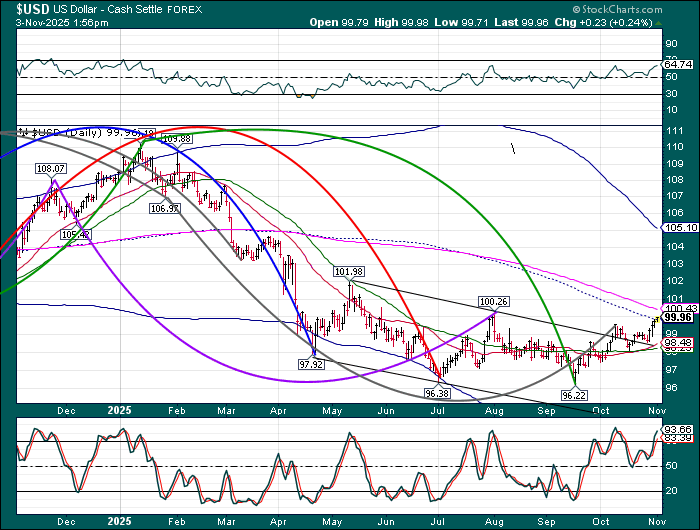

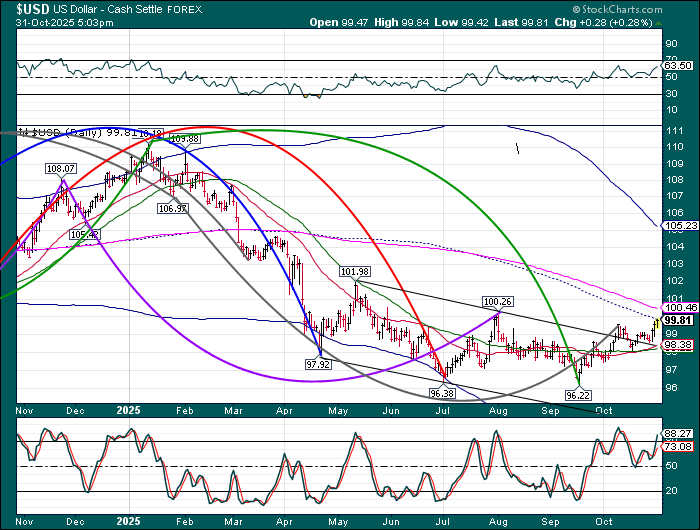

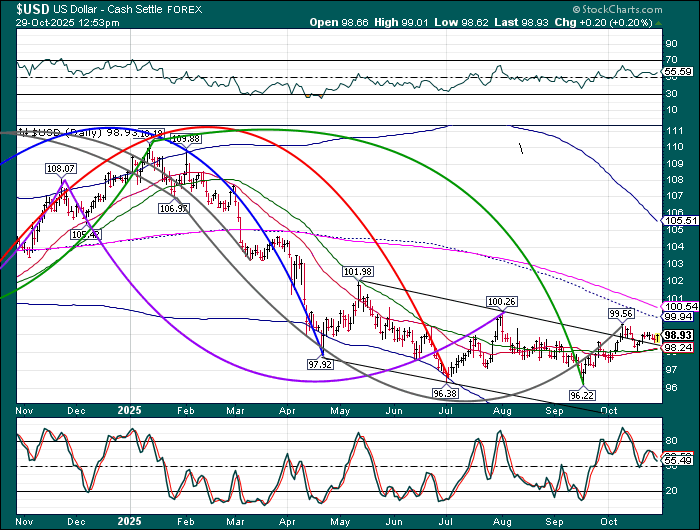

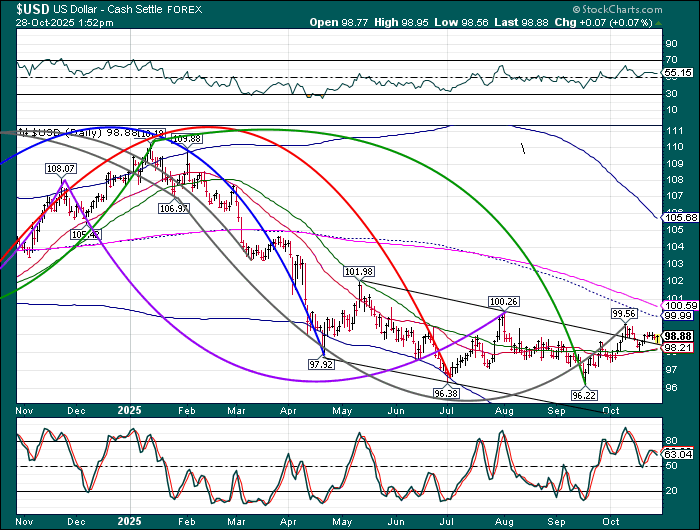

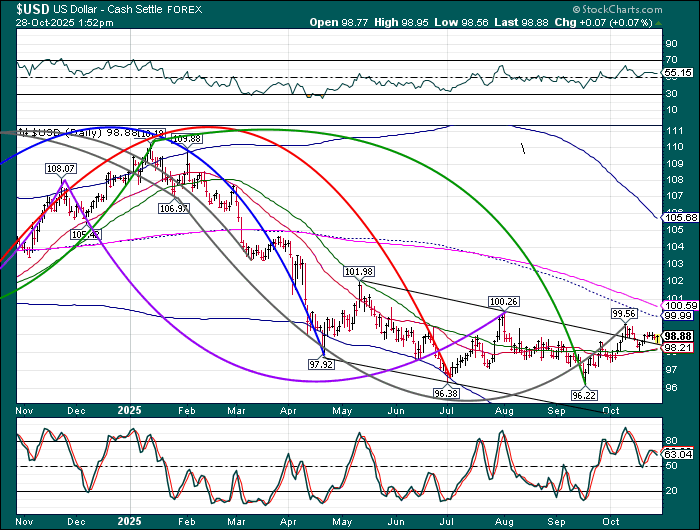

USD is testing its trendline and may decline a bit further. However, thee may be a surge in trending strength after the FOMC announcement. The Cycles Model shows a rising USD through the end of November.

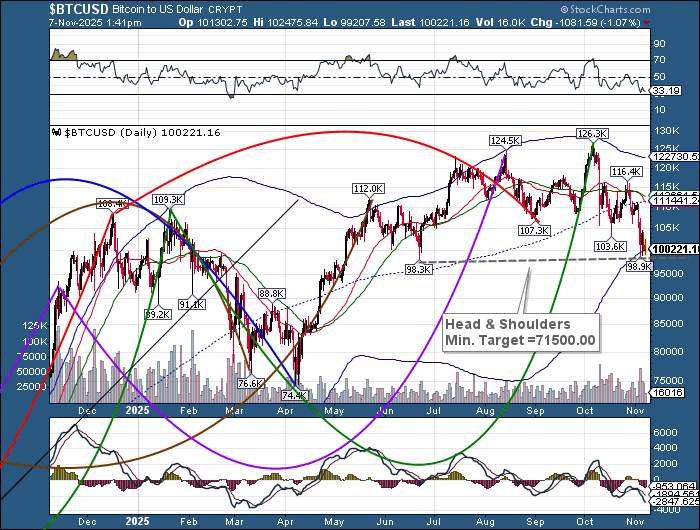

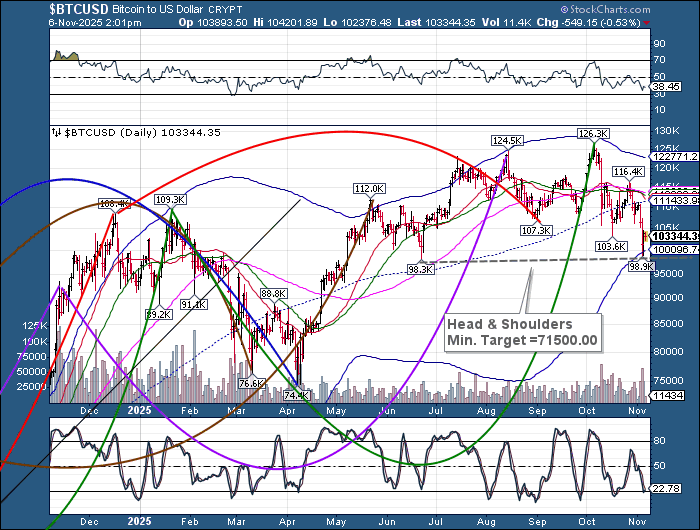

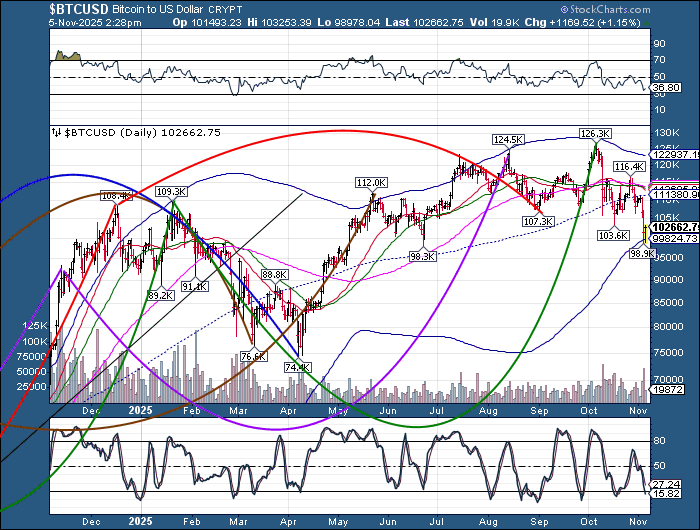

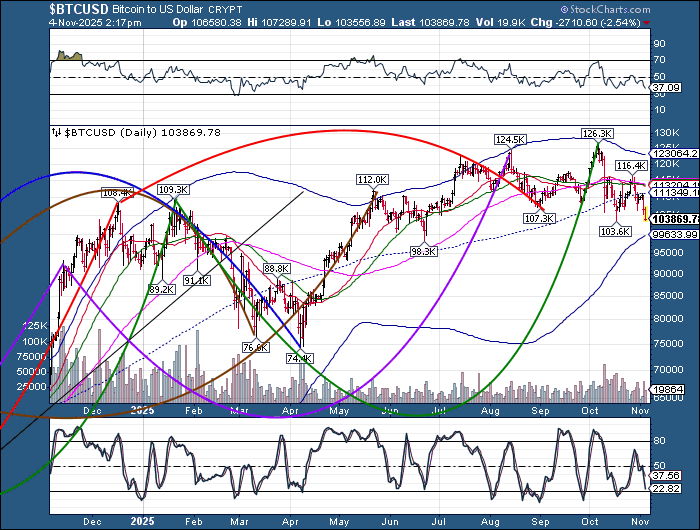

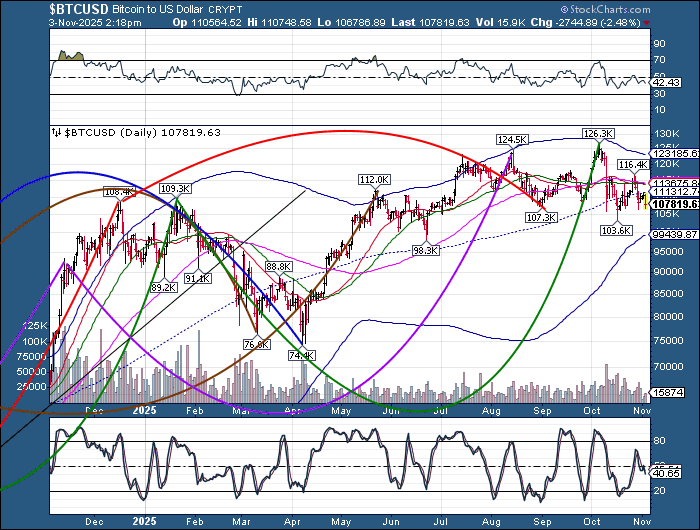

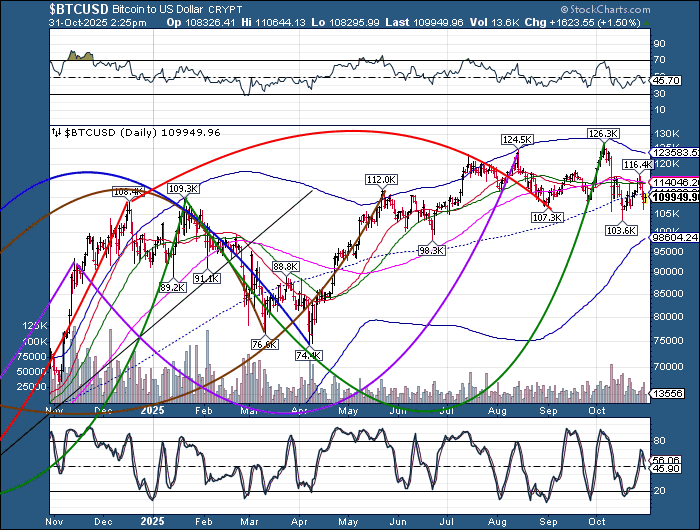

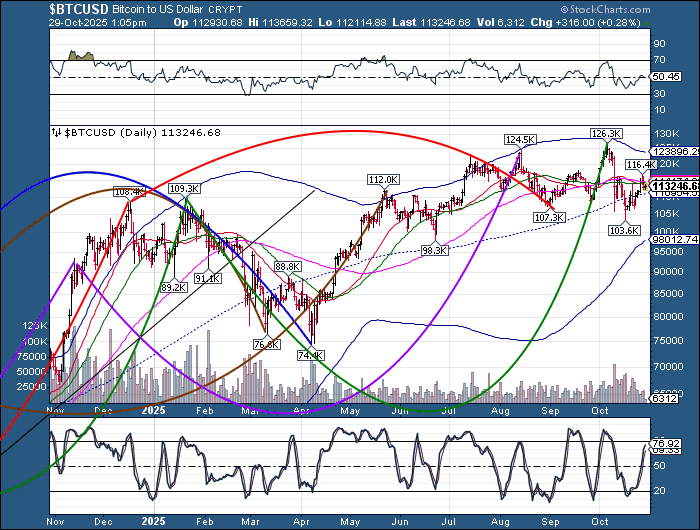

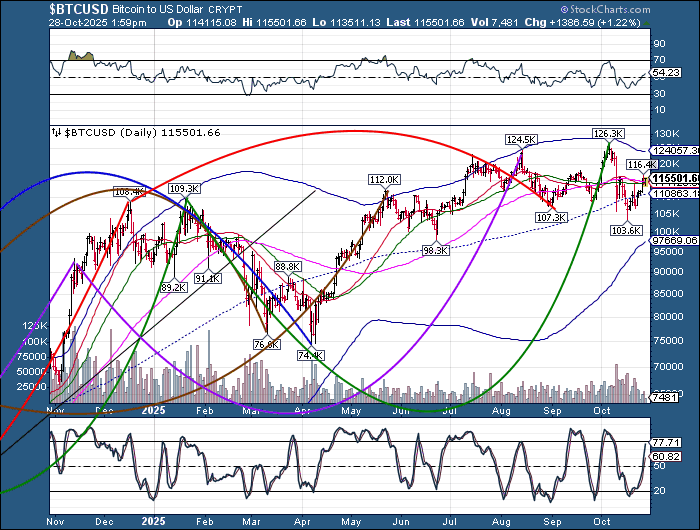

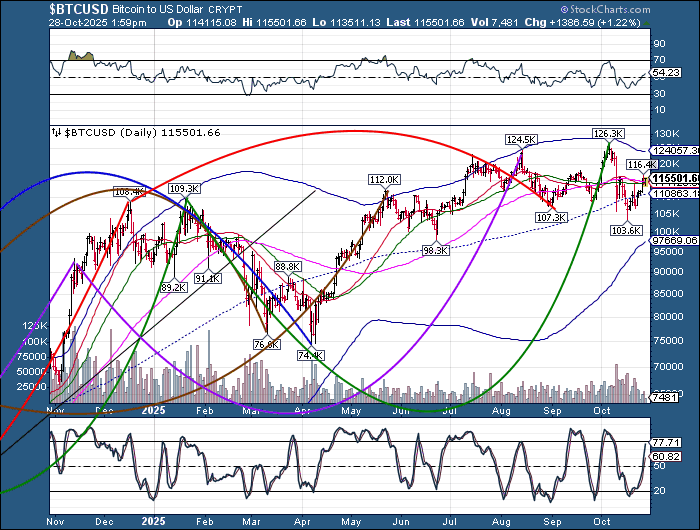

Bitcoin continues to consolidate around the 50-day Moving Average at 114286.00 after making a Fibonacci 61.8% retracement. It still has room to retrace near 120000.00, but it may not last beyond this week.

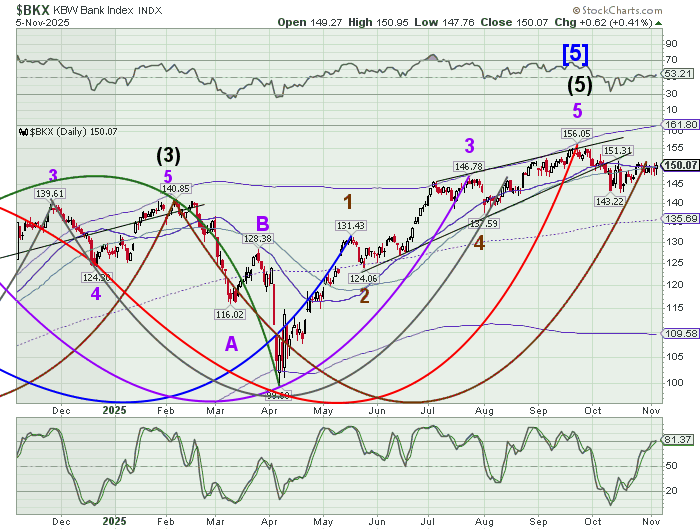

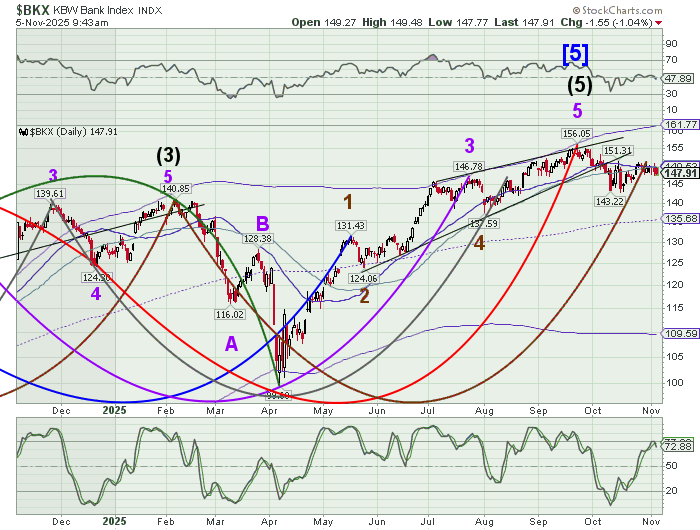

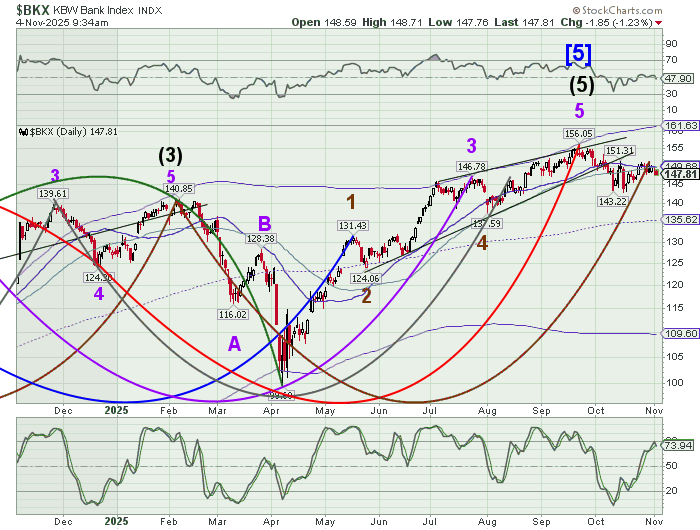

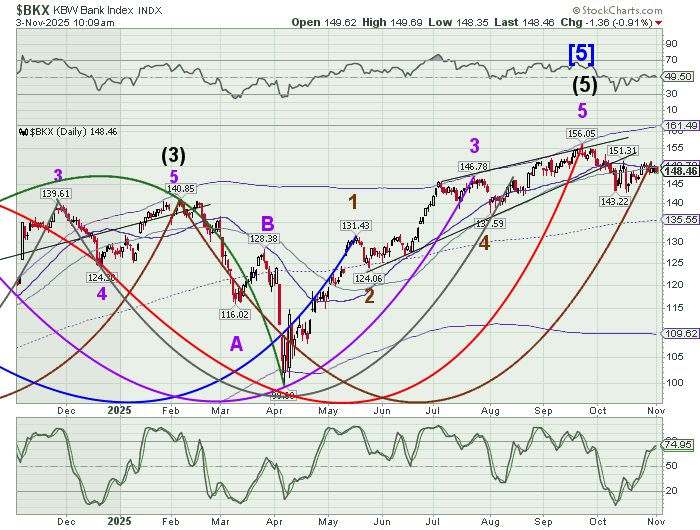

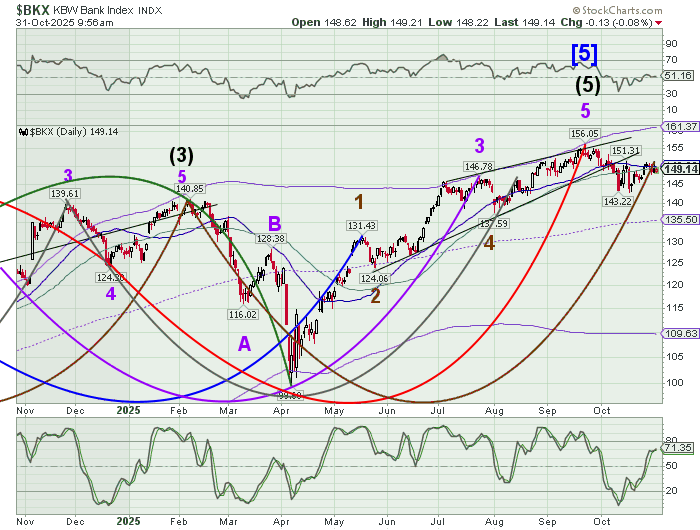

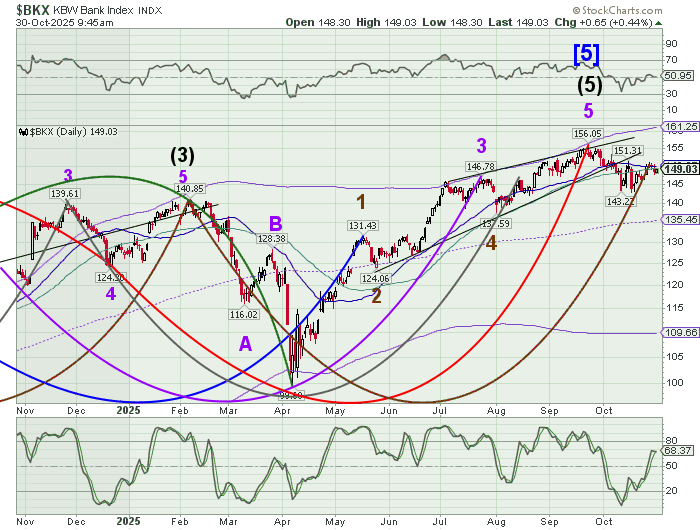

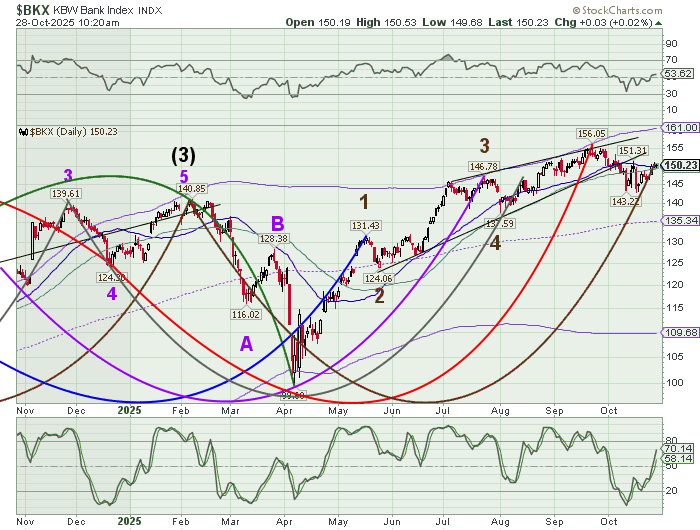

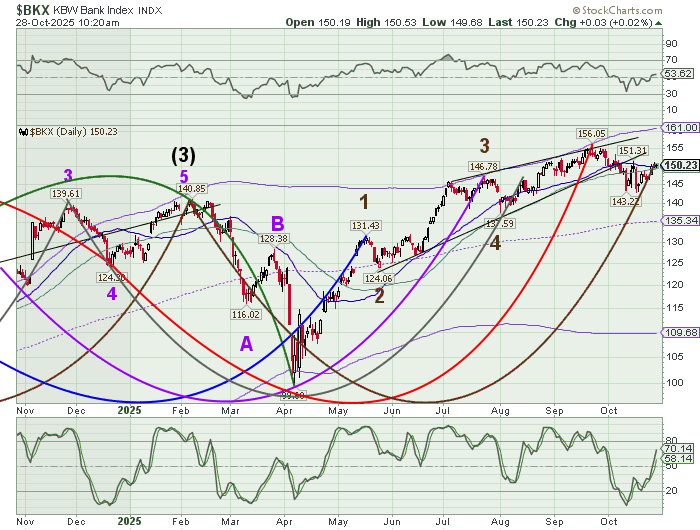

BKX is hovering above the 50-day Moving Average at 149.28 as it completes its current Master Cycle. A decline beneath that level produces an actionable sell signal. The next visible support is the mid-Cycle support at 135.34. The Cycles Model suggests a decline may ensue until late December.